In September 2021, Draper, the motorized shades and projection screens manufacturer, unveiled its Draper@Home line of products, signaling a renewed focus on the residential custom integration business after decades of success in the commercial market.

That unintended “soft launch” of Draper@Home at a lightly attended CEDIA Expo 2021 (due to the Delta variant of COVID-19) might have been a blessing in disguise for the company from tiny Spiceland, IN. It essentially allowed Draper to test the waters a bit more in the resi channel, learning what other business support elements and product features were needed to properly service residential dealers.

As the company gained valuable insights and feedback, they joined the HTSA buying group, promoted 20-year company veteran Clint Childress to director of residential markets, and began hiring regional sales managers to help bolster its focus on the custom channel even further. The company also works with 10 rep firms in the residential channel.

During a recent visit to Draper headquarters, I learned more about what motivated the modest, midwestern manufacturer to broaden its focus after so many years of commercial success.

Before taking a tour of the factory with Childress and Director of Marketing Penny Sitler, I met with Childress and Sitler, President Chris Broome, Vice President of Sales Lee Denhart, Director of Audio Visual Sales and Marketing Randy Reece, and External Communications Specialist, Terry Coffey. We discussed the company’s ongoing success in commercial markets, unique manufacturing capabilities, overly humble approach to self-promotion, and, most-important, what drove the decision to target the residential market so much more aggressively.

Having followed Draper for so many years and visited the factory on two other occasions, a lot of what we discussed was a refresher for me. What I really wanted to learn was why the company had decided to double down on residential, after so many years of commercial focus. Denhart got to the heart of the matter right away.

“I think the thing that led us to focus more on residential was the pandemic. One of the key products that we’re approaching the market with is exterior shading,” he said. “When the pandemic hit, everyone was at home. They wanted to expand their living space. Our exterior business just shot through the roof. We started engaging with the residential market more.”

The company, as Childress reminded me, had spent the last 30 years developing capabilities to go after the biggest commercial players in the motorized category. With their sudden popularity in providing outdoor shading on the residential side (including a partnership with European manufacturer Warema for exterior Venetian shades) the company started taking a closer look at how they could expand those outdoor sales to the inside of the home, demonstrating what Draper does differently from other competitors.

“We knew that we had the capability to customize existing products through our fabrication process,” Denhart noted. “We also can create products from the ground up from a napkin design, which is really something the residential market was lacking.”

Not only that, but the company has been able to ship on time, “quick ship,” and provide custom services, throughout the pandemic and during the supply chain crisis.

Childress emphasized that Draper isn’t completely new to residential. The company, for one thing, has been a CEDIA Expo exhibitor for many years. Now, they’re offering a more “definitive program,” with more changes to come, from the pricing model, making fabric samples available, to having a more dedicated sales force.

“It’s a bigger emphasis than we’ve ever put on it before,” Childress said “Having a program they can go right to versus trying to work with a commercial contact to place an order, is essential. Having this dedicated infrastructure should be a much better customer experience for the residential channel.”

And, although much of the company’s focus has been on commercial, that know-how runs deep. “We definitely have learned a lot on the commercial side,” Childress noted. “There’s a lot of experience in this room. I’m the shortest tenured person in this room, and I’ve been here 22 years, which gives you some idea.”

Draper prides itself on listening to its customers and learning from their feedback. That process has been ongoing and will continue into the future as the company learns what else it needs to do to adjust to the idiosyncrasies of the residential channel. As Childress put it, it’s all about asking the right questions: “If you’re not buying from us, why not? Is it the product? Have we made it too difficult to quote or to understand the product? Is it not the right product mix?”

The company understands that expectations from a homeowner can be a lot different than a commercial building general contractor or architect. On commercial projects, Childress pointed out, the concern is generally a more black-and-white, such as, “What’s in the contract and what do you supply?” But in residential, the dealer will say, “You have to fit what you do into everything else that I’m integrating into the project.” That might mean having control drivers and technology integration capabilities and making sure the hardware is set up to play well with everything else being sold. It’s not just a contract for one scope.

Also, on the residential side, it’s the homeowner’s money being spent on the project, so everything from the look of the product to the light gaps around shades and the construction of the products needs to align.

“We need to learn the expectation of the customer and gravitate toward that from our commercial experience,” Childress said.

Video: How Draper Makes a Shade

Having accomplished so much on the commercial side gives Draper leverage to bring a lot of manufacturing muscle. “We have a lot of ability to do unique things that this residential market probably hasn’t seen,” Childress explained. “Our goal is to expand the residential market. It isn’t just to come in and say, ‘We have a roller shade.’ Instead, it’s ‘Here’s shading systems setups and products to expand the marketplace. It’s about providing more solutions.”

The sheer scale of the projects that Draper has completed on the commercial side should be comforting to anyone working with the company for the first time. Their custom designs have covered the glass roof of Canadian Parliament with sun-tracking louvers that rotate 180 degrees in three-degree increments, moving 60 times a day, and Draper’s tension-shading systems cover the America Museum of Motion Pictures in Los Angeles. They even have operable louver systems in the Metropolitan Museum of Art in New York City.

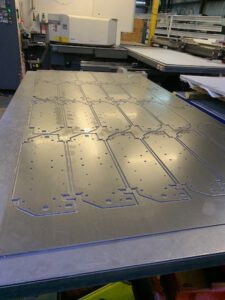

Combined with that experience, you can also mix in the diversity of in-house capabilities, such as custom printing of motorized shade fabrics and custom vinyl coatings for the company’s TecVision line of projection screens, as well as the ability to mill out extrusions, bend metal, use a laser cutting or turret presses. The company has even begun fabricating mounting structures for hanging large-scale direct-view LEDs.

And even though the Draper’s outdoor shading capabilities were what originally piqued the interest of the resi channel during the COVID-19 shutdown, the company’s ability to ship products efficiently, despite the worldwide supply chain slowdown, is now drawing additional interest from residential business partners.

“We’re averaging 10 to 15 working days of lead time,” Childress said. “People right now are probably sitting on orders (with other manufacturers) that they can’t bill until 2023, so we’re letting everybody know that we’re shipping products within the calendar year, and maybe giving them another incentive to switch over to us.

And not to be outdone by a certain well-known motorized shading manufacturer to the east, Draper has cleared land for a 100,000-square-foot addition to its headquarters that will allow them to raise their quality, improve lead times, improve products even more.

“When our expansion is complete, that will give us 500,000 square feet under roof,” Broome noted.

For Draper, which has been a key contributor to the surrounding community for 120 years, that means even more products that are made in U.S. by a local workforce of 720 employees with an average overall tenue at just under 15 years per employee.

“Our U.S. supply chain is critical to our success,” Denhart said. “We’re not reliant on Chinese-made fabrics and container shipments. Fabric supplier Phifer is in Alabama, and Mermet is in South Carolina. Out of everything during the pandemic, that was what really helped us to stay ahead on the service side.”

Most metal extrusions come from U.S. suppliers, as well. Although residential motors are sourced from Somfy in France, Draper had foresight on where bottlenecks and other issues might occur shipping and invested in that inventory ahead of time.

So, as Draper continues to adjust its approach to better serve the residential channel, they have the luxury of already-established business relationships and a thriving commercial business side that allows the company to methodically build up its newer offerings the right way, without pressure.

“We can develop these relationships over time and learn from the channel, asking, “What do you need? How can we help you?” Denhart said. “Most of our product innovations and our service advancements have come from the channel via direct communication, just like that.”

It’s a work in progress, that is still at the early stages, but it’s clear that Draper will do what it takes to succeed in the residential channel.

![integrateu header [Photo credit | IntegrateU]](https://restechtoday.com/wp-content/uploads/2025/05/integrateu-header.jpg)