It’s a tired process, trying to compare current economic conditions or spending habits to those of just a few years ago. Pandemic spending (and the pandemic economy) was unlike anything we’ve witnessed before and hopefully will ever witness again. What that period of time did, though, was reset so many spending cycles and front load projects that many homeowners and integrators likely weren’t expecting.

Demand was high. And it’s since cooled off.

However, as the world faces a new economic reality – one consumed with the threat of tariffs and the resulting increased cost of, well, everything – there’s a chance we could see that demand, particularly in the home remodeling sector, start to tick back up, according to a few different sources. And, funny enough, the turnaround could be because of the same tariffs that are threatening to hinder so many other markets.

A recent blog from a member of the National Association for the Remodeling Industry helped explain how that could be possible, and it boils down to some simple math. The perception around the homebuilding space is that costs are going to skyrocket because many of the types of goods this this space relies on – wood, steel, lumber, flooring, etc. – would be exposed to tariffs. However, only about 7 percent of materials used in U.S. residential construction is imported. So, any price increase would likely be nominal.

Diving deeper into the budget numbers, NARI explained that any impact within the remodeling industry specifically would be even less significant than in new-home construction. Looking at a $150,000 kitchen remodel, for example, material costs account for about 5-6 percent (1 percent for lumber, 2 percent for trim and casing, and 2-3 percent for cabinets). And, even if those materials faced full tariffs, you’re talking about a $2,250 – $3,000 impact. New home construction, on the other hand, would see those numbers eat up a much larger portion of the budget and, thus, would see far more significant price increases.

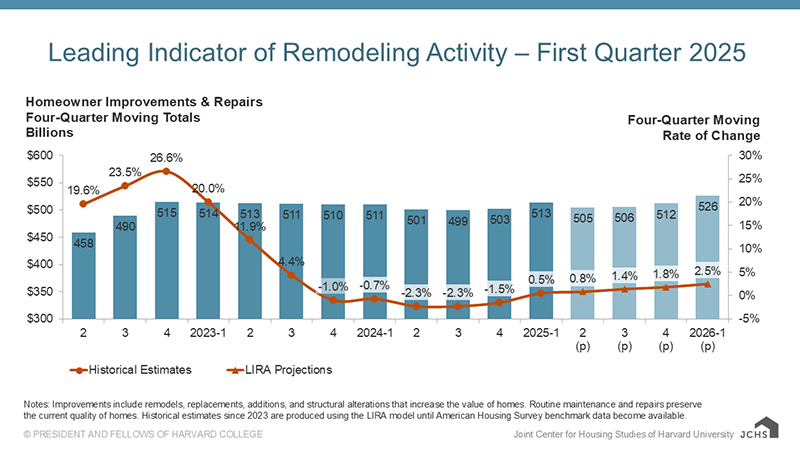

Tariff impact aside, other data sources point to increasing opportunities in the home remodeling sector. According to the Joint Center for Housing Studies’ Leading Indicator of Remodeling Activity (LIRA) report, year-over-year homeowner improvement and repair spending throughout 2025 and into 2026 will increase every quarter – something it hasn’t done since Q3 of 2023. The turnaround is, in part, due to recent increases in the sales of existing homes, which should drive spending by those new homeowners on upgrades to their new abodes.

The Center’s Managing Director Chris Herbert did say that the outlook could be impacted by tariffs, but “high home values and other strong economic indicators have supported an uptick in homeowner improvement spending.”

And, to that end, as home improvement spending rebounds, custom integrators should be out there getting themselves in front of those projects in order to take advantage of the increase in demand for their services.